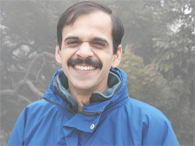

Girish Sant, one of the pioneering analysts and advocates of pro-people, scientific policies in the energy sector, passed away on 2nd February 2012 at New Delhi due to cardiac arrest. He completed his B. Tech. in Chemical Engineering from IIT-Bombay in 1986 followed by his Masters in Energy Systems Engineering in 1988. As a student, Girish was a keen mountaineer and loved spending time in the Himalayas.

Girish started his professional career by teaching Chemical Engineering in the Bharati Vidyapeeth College, Pune followed by a short stint with the Systems Research Institute where he researched trends in energy and appliance usage with changing urbanization in Western Maharashtra.

In 1989, Girish began work on macro-level energy policy and planning, starting with a detailed Integrated Resource Plan for Maharashtra inspired by the pioneering work of his mentor, Prof Amulya K N Reddy from Indian Institute of Science.

Girish’s firm belief that professional skills should be used to address pressing social questions led him along with his doctor and engineer friends to start PRAYAS in 1994. The word ‘Prayas’ means ‘focused effort’. Prayas is a non-governmental, non-profit organisation based in Pune, India. Prayas undertakes public interest oriented policy analysis in the areas of Health, Energy and Livelihoods. Members of Prayas are professionals working to protect and promote the public interest in general, and interests of the disadvantaged sections of the society, in particular. Prayas Energy Group believes that effective control and influence on governance by people and civil society organisations is the key to efficient governance that would protect and promote public interest. Public interest issues include consumer issues as well broad social issues. In consumer issues, Prayas gives more attention to the issues affecting the poor and the disadvantaged. Social issues include environmental sustainability and equity. Girish was the coordinator of Prayas Energy Group, which made significant contributions over the last two decades through policy analysis and advocacy in the electricity sector.

Some of Girish’s well-known contributions include the scientific critique of the Enron power project; analysis of Sardar Sarovar’s power project, constructive engagement with the electricity regulators and preparation of a Citizen’s Primer on the electricity sector. Some of his recent contributions include implementation innovations in the areas of energy efficient appliances and renewable energy systems for meeting India’s energy needs. He represented India in several international for a on climate and energy issues; authored a range of scientific papers; won several awards, and was a member of various committees of government as well as civil society.

Recently, as a member of the Climate Experts’ Group under BASIC countries, of the Planning Commission’s Experts Committee on the Low Carbon Strategy for Inclusive Growth, and the 12th Plan Steering Committee of the Ministry of Non-Renewable Energy and Ministry of Power, he courageously and relentlessly championed the cause of the weaker sections of society and the long term interest of the nation.

His hard work, his commitment and dedication to the cause of the marginalized are an example for everyone to emulate. His work was characterized by a high analytical rigour and fairness, and honesty with which he approached policy analysis and innovation. He always strived for and was driven by the need for tangible impacts.

Girish was truly a great team leader and team builder and had an innate ability to inspire and motivate everyone to strive for something higher. Above all, his friends and colleagues remember him for his humility, simplicity, and the humane touch in his professional and personal relationships. He achieved a lot in his short lifetime, and leaves behind lot of work to be done. We at Prayas enjoyed working with him and plan to carry on the work he started - the best tribute we could give him.